By Harold Vandelay on Feb 08, 2019 08:24 pm

The University of Michigan (UM) in the US is to establish a collaboration through cryptocurrency through Ripple’s University Blockchain Research Initiative (UBRI). Michigan has joined a number of universities, now numbering 11 in all, who have formed a partnership with Ripple under the scheme aimed at supporting academic research, technical development, and innovation in blockchain, cryptocurrency and digital payments. UM has announced that it plans to encourage multidisciplinary curricula in fintech through the creation of a center which will also focus on engineering and business use cases for cryptocurrencies in new applications such as smart cities. A statement from the university announced: “The most important thing this funding allows us to do is integrate the engineering and data science with finance and policy to craft financial models to fund infrastructure, developing models to close the infrastructure finance gap.” The grant of USD 1 million as part of Ripple’s USD 50 million UBRI, includes some of the world’s most prestigious universities including Princeton University, MIT, and University College London (UCL). Several universities across the US, along with others in South Korea, the Netherlands, Luxembourg, India, Brazil, Cyprus, and Australia are also included in the project, giving the initiative a distinctly international flavor. Last year Ripple contributed USD 50 million as part of the same initiative in South Korea alone, demonstrating the company's intent to promote more interest in cryptocurrency in that country. The new center at UM, to be named The Center for Smart Infrastructure Finance, will support interdisciplinary initiatives along with the College of Engineering, Ross School of Business, Ford School of Public Policy, and the College of Literature, Science, and the Arts. Senior vice president of global operations at Ripple, Eric van Miltenburg, sees such collaborations as a necessary step towards pushing blockchain technology forward. He commented. “In less than a year, we are already seeing UBRI partners create new cross-disciplinary research programs and courses, as well as collaborate with one another to share ideas on how to grow the blockchain ecosystem,” said van Miltenburg. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: Pixabay The post Ripple Initiative Results in $1 Million Windfall for University of Michigan appeared first on BitcoinNews.com.

Read in browser »

By Manuel on Feb 08, 2019 06:23 pm

The Bank of Korea (BOK) has said that the introduction of a state-owned and issued digital currency in the form of central bank digital currency (CBDC) in South Korea could possibly zero-out commercial banks, reports Yonhap News Agency. According to the source, the BOK published a report expressing concerns with low deposits demands into commercial banks that may result from the implementation of a state-backed CBDC into the financial system. Kwon Oh-ik, one of the co-authors of the report, wrote: “The CBDC is a kind of a BOK-issued bank account. People trust it more than one in a commercial bank”. This implied that as customers are likely to trust the blockchain-based currency type backed by the BOK as opposed to the legacy form of money transfer and handling, this might lead to low liquidity in such commercial banks as customers withdraw their money. This would invariably shoot up interest rates. Commercial banks are largely dependent on the loan infrastructure and if deposit services reduce, making it hard for the banks to have access to liquid cash for loan maintenance, then interest rates will then go up. Invariably, that may reduce patronage and consequently reduce the businesses of such banks. Banks around the world have been discussing different application models for blockchain and cryptocurrencies. One such possibility involves CBDC, and talks about facilitating cross-border payment infrastructures. Banks have identified CBDCs as a government type of cryptocurrency which will constitute the exactness of a fiat currency. At last, one thing some central banks around the world and crypto-enthusiasts could agree on is that a digital asset built on the blockchain could represent a store of value as well as a medium of exchange, and possibly capable of replacing the legacy fiat currency formats. A CBDC could play a significant role in mass adoption of cryptocurrency. However, as exciting as that may sound for Seoul-based crypto enthusiasts, the South Korean central bank has a differing opinion. The bank did say last week that it is not rushing into issuing a CBDC even though many financial institutions around the globe are more welcoming to the prospects of the financial instrument. The report published by the bank further reiterates its stance on the subject of CBDC. Follow BitcoinNews.com on Twitter: @BitcoinNewsCom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: Bitcoin News The post Bank of Korea: CBDC Could Threaten Commercial Bank Stability appeared first on BitcoinNews.com.

Read in browser »

By Manuel on Feb 08, 2019 04:21 pm

A popular trend as the cryptocurrency industry develops is the introduction of the analogous derivative instruments of the traditional financial market, aimed at luring in institutional investors into the crypto world. One such instrument is the exchange-traded fund (ETF). CEO of leading cryptocurrency exchange Binance, Changpeng Zhao, has, however, downplayed the role of ETFs in the growth of the crypto industry. He said: “If it [a Bitcoin ETF] is listed on a big traditional exchange… that does bring in a lot of attention from people outside our industry.” In a live stream via Periscope on 6 February, Zhao attempted to draw the attention of crypto enthusiasts to a very important piece in blockchain development – entrepreneurs building real, and usable products. Blame it on the bear The bear market which started at the cusp of the last all-time high of Bitcoin hasn’t made it easy for crypto projects. Many startups last year faced developmental challenges and were either forced to abandon their projects or get absorbed by another. Now, lots of players in the industry have become highly dependent on these market derivatives being introduced. First, it was Bitcoin futures introduced by CME Group and CBOE in late 2017, which helped drive the price of Bitcoin to a new high of USD 20,000. However, it didn’t last long. Suffice to say, it was an opportunistic glitch in the price dynamics of Bitcoin. Secondly, speculations about another bull-run propelled by ETFs run deep in the crypto community. Perhaps similar trends are bound to occur with more derivatives being introduced into the sphere, however, without an established value-based blockchain ecosystem in place, the market could get dire once more. ETFs or no ETFs As of the time of writing, the US securities regulator, Securities Exchange Commission (SEC) has rejected nine ETF applications. Each was laden with similar bull run expectations from the members of the crypto community as many have speculated on the prices increase should the SEC give the green light. Recently,CBOE, along with investment firm VanEck and financial services company SolidX, reapplied for a rule change to list Bitcoin ETFs after withdrawing it a week earlier. With the ongoing fuss about Bitcoin ETFs, Zhao seems to think that with or without the ETFs, the industry will grow. A sentiment probably sparsely shared as focus on the real development of blockchain and its applications are fairly the driving motif for latter blockchain adopters. Other derivatives are coming Bitcoin News recently reported a new class of derivative instrument being introduced by US-regulated derivative platform LedgerX, which is essentially a binary wager on the next Bitcoin’s block-reward halving. While derivatives may be an economic milestone for the crypto industry, the overall utility of blockchain applications and their gradual adoption by legacy systems adequately offset the economic benefits of derivate crypto markets. Follow BitcoinNews.com on Twitter: @BitcoinNewsCom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: Pixabay The post Binance: ETFs Not Core to Crypto Growth appeared first on BitcoinNews.com.

Read in browser »

By Manuel on Feb 08, 2019 02:19 pm

Swiss multinational investment bank and financial service company Credit Suisse confirmed today that its asset management arm which manages over USD 400 billion has successfully tested a blockchain-based cross-border transaction, as reported by Reuters. According to the post, parties involved in the test — Portugal’s online bank Banco Best and Luxembourg-based order-routing platform Fundsquare — confirmed that a blockchain-based platform was used “to process an unspecified number of trades”. The attestation stated that the test showed cross-border payment processing which was distributed over the blockchain and is more efficient, scalable and timely in processing. According to the source, “the investment fund industry relies heavily on transactions and settlements that are often complex and time-consuming to process”, hence the need for a transition to a more secure and fast system to scale up processes. As it stands, blockchain much-cited edge as a distributed immutable ledger becomes the preferred choice under the circumstances. The post also notes that because of the quality of the blockchain, fewer checks are needed to ensure entries are secure, which in turns saves time. While the test was successful, the parent company made no comments on whether future applications of the technology will be expanded. For banks and many financial institutions, optimizing cross border payment processes through blockchain is increasingly becoming an important use case of the blockchain. Last December, UK fund processor Calastone said it could save up USD 4.3 billion using blockchain and would be moving its operations by May this year. Recently, major Swiss exchange SIX said it was ready to launch its SDX trading platform using blockchain. Saudi and UAE have reportedly been collaborating to develop a cross border payment system basically designed for bank-to-bank transactions only through the blockchain, and currently, have a select few commercial banks participating. Follow BitcoinNews.com on Twitter: @BitcoinNewsCom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: Pixabay The post Credit Suisse Successfully Tests Blockchain for Cross-Border Payments appeared first on BitcoinNews.com.

Read in browser »

By Talha Dar on Feb 08, 2019 12:17 pm

There are reports of email being received from what claims to be Bitcoin futures trading platform Bakkt. The emails, bearing the subject line “Bakkt News!” and purporting that the platform will launch on 12 March 12, at first sight seem convincing. First of all, the email is sent, not from an official Bakkt account, but from a Gmail one. Secondly, the English used in the email itself is written in a manner that clearly suggests an automatic translation program was used to compose it. Thirdly, the email diverts users to a website, bakktplatform.io, which is not the official Bakkt website. The website simply asks visitors to register by providing their name and email address. The complete lack of KYC, AML checks and other information leaves no doubt on the fake nature of the website. Post registration, investors are presented with a Bitcoin address where they can transfer their investment. The website also asks for investors’ Bitcoin addresses, with the promise of giving profit returns within three days of the platform’s launch. The actual Bakkt has denied any connection with the email and the website, saying, “…that is not a Bakkt website and we wouldn’t have communicated in that way.” The real platform also does not have any launch date at the moment. The platform has still no green light from regulatory point of view. Unless that is given, it cannot even start to offer its services. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: pexels.com The post Fake Bakkt Emails Circulate, Claiming Profits for Investors appeared first on BitcoinNews.com.

Read in browser »

By Talha Dar on Feb 08, 2019 10:16 am

MIT researchers have claimed to develop a new cryptocurrency that requires an astounding 99% less space than Bitcoin to store data. The cryptocurrency, dubbed Vault, is based on Proof of Stake, a concept that is resource efficient and requires little energy to process. According to the MIT developers, Vault will be deployed within this year. Ethereum's current estimate to shift from PoW to PoS is roughly between 2019 and 2021. For some, the race to become the first cryptocurrency that purely uses a highly-efficient PoS algorithm is on. Vault takes advantage of being built with PoS in mind, with a team that is from the finest technical institution in the world. Ethereum, frequently battling with Ripple (XRP) for the position of the second largest cryptocurrency, has long planned of shifting to PoS, but till now has not been able to do so, citing upgrade issues. The issue faced by Ethereum is called the Trilemma, a concept proposed by its founder, Vitalik Buterin. The three-pronged dilemma says that only two of three characters can be achieved by any cryptocurrency: security, scalability and decentralization. Indeed, no cryptocurrency has ever been able to achieve all three. Even Ethereum has plans involving several steps to solve this issue. This includes the transition to PoS and development of layer 1 and layer 2 Ethereum. Silvio Micali, a professor at MIT, claims to have found the solution. Using a fragmented Merkle Tree, it will allow nodes to store only data from the fragmented line. This would allow completing of transactions without downloading the complete data history of the blockchain. For situations where the transaction is from one fragment of the Merkle Tree to another, a special method will be used to search for nodes that intersect both the fragments. Vault’s technology and method are seemingly sound, but it still has to prove it. Ethereum, on the other hand, still has to complete the migration process. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: bitcoinews.com The post Race to World's First Pure PoS Crypto: Ethereum vs Vault appeared first on BitcoinNews.com.

Read in browser »

By Talha Dar on Feb 08, 2019 08:13 am

A new ICOBench report has shown that in Q4 of 2018, initial coin offerings (ICOs) raised 25% less than Q3 2018. The same reporting period saw the number of completed ICOs jump from 554 (in Q3 2018) to 594. The same quarter witnessed a surge in the number of ICO projects that were unable to raise funds. Nevertheless, the number of successfully completed ICO projects remained constant. The report claimed that a total of USD 1.4 billion funds were raised in Q4 2018, down from USD 1.8 billion in the previous quarter. Project average amounts also declined from USD 8.9 million (Q3) to $6.7 million (Q4). The report identified that Ether (ETH) was accepted by 88% of listed projects to raise funds. This hints at an important factor related to the decline in the price of ETH (down by 43% since November 2018). This decline in ETH price has become a reason for the decline in dollar value of raised funds in Q4, as ETH targets remained the same. Although a below-par performance was displayed by the ICO market in terms of raised funds, a better record of hard caps was demonstrated in Q4 as compared to Q3. It means that many ICO projects in Q4 managed to reach the maximum amount of funds targeted from investors. Singapore was rated as the top country in terms of the number of completed ICOs and the amount of funds raised. The report noted that in Singapore, 85 ICOs raised USD 251 million in Q4. This was followed by Switzerland (USD 238 million) and the US (USD 159 million). In another report, ICObench ranked Canada as the number one country in terms of funds raised (USD 80 million), during the first half of January. However, the US was ranked first in terms of the number of ICO projects. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: pexels.com The post Q4 2018: ICOs Increase but Investment Declines 25% appeared first on BitcoinNews.com.

Read in browser »

By Talha Dar on Feb 08, 2019 06:11 am

The Chamber of Digital Commerce, Canada’s largest blockchain trade association, has decided to join hands with the Blockchain Association of Canada (BAC). The new organization will be named as the Chamber of Digital Commerce Canada. An official press release on the website of the Chamber of Digital Commerce confirmed the news of this partnership. Tanya Woods, executive director and policy strategist of the BAC, will serve as the managing director of this new association. Woods has experience of working with Microsoft, BCE, the Canadian government and Nintendo. She stated in the press release that a strong and coordinated blockchain ecosystem is desired by the Canadian government and blockchain leaders. Such a system should facilitate a collaborative environment and ensure the progress of blockchain technology in Canada. Executive chairman of the Blockchain Research Institute, Don Tapscott, expressed his views by saying that Canada had the potential to become a world leader in the crypto sector. He believed it essential for Canada to have a united blockchain community. Established in July 2014, the Chamber of Digital Commerce comprises of 200 companies. These companies include tech-giants like Microsoft, Bitpay, IBM and Overstock. These companies are now looking to invest in blockchain technology. Recently, in October 2018, reports came out that a blockchain shipping solution developed by IBM would be used by the Canada Border Services Agency (CBSA) on a trial basis. The blockchain-based system is expected to bring cost effectiveness, fewer errors and automation of distribution and trade processes. Owing to its favorable regulations, low energy costs, innovation and high-speed internet, Canada is poised to become a global leader in the crypto sector. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: bitcoinnews.com The post Blockchain Association of Canada Merges with Chamber of Digital Commerce appeared first on BitcoinNews.com.

Read in browser »

By BitcoinNews.com Reviews on Feb 08, 2019 05:06 am

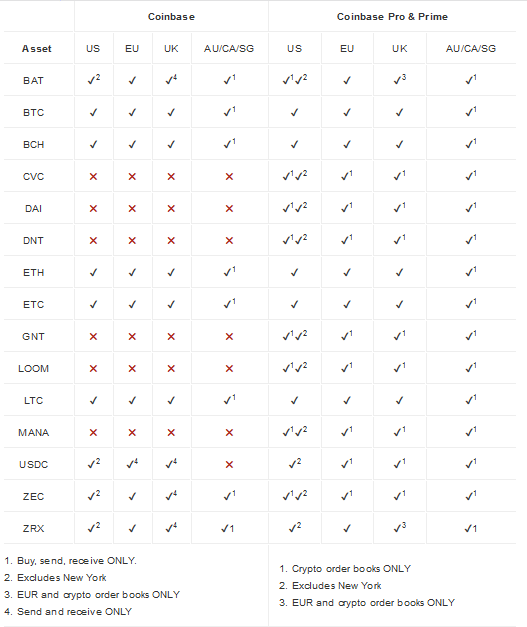

Coinbase, a US-based fintech company founded in 2012, is one of the most popular cryptocurrency exchanges in the world with over 20 million customers in 42 countries. It offers wallet and exchange services for inexperienced traders, cryptocurrency enthusiasts and institutional investors which are backed by Federal Deposit Insurance Corporation (FDIC) protection for US residents and is registered as a Money Services Business with FinCen. This Coinbase review will take a good look at its brokerage, exchange and wallet services for everyday users, including how to get set up, verification requirements, security, privacy, digital assets and products offered. Find out if Coinbase is the right option for you by reading this Coinbase review. Coinbase the company Coinbase has two company priorities, to “be the most trusted” and to “be the easiest to use”. In terms of trustworthiness, Coinbase has a pretty strong reputation due to its long history and experience as a Bitcoin broker. Over time, it has expanded its services and is currently regulated by FinCEN and follows various laws and regulations such as the USA Patriot Act and the Bank Secrecy Act to ensure that customers enjoy a secure experience with a legitimate company. Coinbase complies with EU GDPR regulations and US residents receive FDIC insurance up to USD 250,000 for all US dollars deposited and held in Coinbase accounts which are in turn held in US Treasury or in custodial bank accounts. International customers’ fiat funds are also held in custodial bank accounts. Although not terribly important to the average user, it is worth noting that the company has enjoyed strong growth and received USD 217 million in investments from a wide range of entities including BBVA, Reddit co-founder Alexis Ohanian, Bank of Tokyo, Digital Currency Group and Blockchain Capital. As for ease of use, the platform is well suited to beginners and no trading experience is required. Coinbase makes the process of buying cryptocurrencies uncomplicated and quick. Coinbase currently operates in the following countries: | Singapore | Australia | Canada | USA | Austria | Belgium | Bulgaria | Croatia | | Czech Rep. | Switzerland | Denmark | Finland | Greece | Hungary | Iceland | Ireland | | Guernsey | San Marino | Latvia | Slovenia | Malta | Monaco | Norway | Poland | | Isle of Man | Netherlands | Portugal | Spain | UK | Andorra | Sweden | Slovakia | | Liechtenstein | Lithuania | Italy | Cyprus | | | | | Those that are not residents of these countries can use some of Coinbase’s services such as their wallet to send and receive cryptocurrencies, however, won’t be able to buy or sell them. Products and accounts Coinbase has expanded its service in recent years to cater to a wider range of customer needs. We will go over them quickly, however, in this review, we will be focusing primarily on Coinbase for everyday customers. For everyday customers: Coinbase online wallets, exchange services and the ability to buy and sell cryptocurrencies. For advanced users: the Coinbase Pro trading platform, Paradex for Ethereum token trading and asset management. For businesses: accounts with the ability to receive cryptocurrency payments. For institutions: cryptocurrency custody, the Prime trading platform. Conveniently, Coinbase has a mobile app which makes it easy to trade and exchange on the go with either iOS or Android devices. Setup and verification To open an account with Coinbase, users must also verify their account with a photo of a government-issued ID uploaded either via the mobile app or the website. US customers should note that a state issued ID is required such as a driver license. US passports cannot be processed. The rest of the setup process is self explanatory and similar to that of many other exchanges. As Coinbase is a registered entity, it is required to complete a thorough identification process as part of KYC responsibilities and may also require a social security number from some users. Once your account has been verified then you can begin trading and exchanging any of the many cryptocurrencies supported by Coinbase. Cryptocurrencies Coinbase supports 15 cryptocurrencies and although its range could perhaps be wider, it does contain most popular and widely-traded coins. The Pro and Prime trading platforms give users access to several more altcoins. However, these platforms are better suited to advanced and institutional traders, and are beyond the scope of this review. Account funding and fees Payment options and their associated fees depend on your country of residence. Users have the ability to deposit via bank transfer (SEPA transfers for European users), wire transfer or credit/debit card. Bank transfers (ACH) and credit/debit cards will have to be added to your account as a linked payment method and verified. Note: according to Coinbase, it is no longer accepting new credit cards and recommend using a debit card or bank account instead. Coinbase’s fee schedule is somewhat complicated, which can cause some confusion and has led to some negative feedback from users but we will attempt to explain it as simply as possible. When buying cryptocurrencies with fiat funds the total fee consists of two parts. The first part is the price as shown on Coinbase Pro with an added spread of 0.5% as Coinbase attempts to fill the order with other orders from Coinbase Pro. The second part is a transaction fee that is dependent on how much is being deposited and how it is deposited. When less than USD 200, a flat fee depending on the amount is charged and when above USD 200, then a variable fee is charged depending on payment method (or whichever is larger). For example, when purchasing USD 100 of Bitcoin, a flat transaction fee of USD 2.99 would normally be charged. However, when purchasing via debit card, purchases attract a fee of 3.99%, the 3.99% of USD 100 (or USD 3.99) would be calculated as the transaction fee instead of the flat USD 2.99 fee, as it is the larger one. When using Coinbase’s exchange platform, a crypto-to-crypto exchange will be subject to an approximately 1.00% spread and no transaction fee. You can also transfer between different wallets on Coinbase free of charge. ACH bank transfers are free and wire transfers cost USD 10 with a USD 5,000 minimum deposit and USD 25 with a USD 25,000 withdrawal maximum. More information on fees and payment options by location and method can be found here. Although the fee structure is sometimes not so easy to follow, it is reasonable when compared to other large exchanges. Buying limits Buying limits apply and depend on your account level which is based on the level of verification reached. To increase buying limits the following steps can be taken: -

Verify phone number -

Verify personal information -

Verify photo ID (valid state ID for US customers) When all of these have been completed, then a typical US resident will be able to purchase USD 25,000 per day. Security and privacy Coinbase uses several security features to protect users and themselves from various forms of theft. -

Coinbase uses hot wallets to hold 2 % of funds for trading and fluidity with the remaining 98% held in cold storage -

2 Factor Authentication available -

Bank account numbers and routing codes protected by bank level AES-256 encryption -

SSL connection using the platform to prevent other people from seeing your communication/actions on Coinbase -

Background checks are done on all employees Coinbase uses a third-party site, Plaid Technologies Inc, to verify US customer accounts instantly via their bank information. A copy of Plaid Technologies Inc’s privacy policy can be found here if you would like to find out more. Although Coinbase takes security seriously, as it is an online wallet and exchange service, it can never be immune to all threats and you do not have total control over your cryptoassets. A more secure option would be to use a hardware wallet to store your crypto after having bought or exchanged your funds. Coinbase states that their policy of retaining IP addresses and tracking the movement of funds purchased on the site aims to prevent money laundering. This has irritated some users, particularly those that have had their accounts suspended because they sent crypto to the darknet, gambling sites or Localbitcoins, all of which may lead Coinbase to close an account. Customer support Coinbase has spent a lot of time and energy to ensure that the process of buying and selling cryptocurrencies on the site is as painless as possible. However, it is not immune to customer service issues. Unfortunately, it is not difficult to find complaints about the platform on various internet forums and reviews, usually in relation to their customer support services. That being said, we didn’t have any problems when dealing with their customer support and they do have a very good FAQ page that covers a range of topics which is a good starting point before looking to customer support for help. If you would like to contact customer support then you can do so via their ticket service, their support bot, via support@coinbase.com or by phone on the following numbers: US/international : +1 888 908-7930 UK : 0808 168 4635 Coinbase review summary As one of the oldest cryptocurrency exchanges and broker services in existence, Coinbase has had a lot of time to polish its services into some of the easiest to use there are. In terms of fees, for brokerage services such as those offered by Coinbase, it is competitive, as is its range of cryptocurrencies. Perhaps the main issue with this platform is its customer support which has been subject to criticism in the past as well as privacy concerns due to the extensive verification process we mentioned previously in this Coinbase review. In summary, it is fair to say that Coinbase is reputable and best suited for those that are new to the cryptocurrency industry or buying/trading small to medium quantities of cryptocurrencies. It provides a secure, regulated environment that simplifies the process of purchasing, selling and trading. If you feel that Coinbase is right for you, then you can sign up here. Disclaimer: BitcoinNews does not provide any warranties towards the accuracy of the statements in the above Coinbase review. Any content on this site should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to perform your own research of the platform. Trading and investing in cryptocurrencies involves considerable risk of loss and is not suitable for every investor. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: bitcoinnews.com The post Coinbase Review: Is It Right for You? appeared first on BitcoinNews.com.

Read in browser »

By Talha Dar on Feb 08, 2019 03:01 am

SIX Swiss Exchange has decided to use blockchain technology for its upcoming parallel digital trading platform SDX. Switzerland’s leading stock exchange is expecting the integration to happen in the first six months of 2019, media reports claimed. Approximately CHF 5.19 billion (Swiss francs equivalent of USD 5.18 billion) is processed by SIX Swiss Exchange in daily turnover. Moreover, it has a market capitalization of CHF 1.67 trillion (USD 1.6 trillion). CEO Jos Dijsselhof stated that improved security and time efficiency that blockchain can offer in stock trading and settlement is the main reason for the company to develop this technology. He added that in the present system, trades only take a few seconds but it usually takes two days for the buyer to become the owner of the stock. He hoped that by integrating the blockchain technology, the whole process would take only a few seconds. Along with improved efficiency, it should make the process more secure as well. He predicted that a blockchain-powered stock exchange would widen the range of tradable titles. Romeo Lacher, SIX exchange chairman, told Reuters that the launch date of the new platform would be announced after legal and regulatory clarification with the Financial Market Supervisory Authority, adding that the announcement was expected by the end of summer. The company expects that its SDX digital exchange will supersede its current market place by 2029, noted Reuters. SIX is also aiming at launching its own security token offering, allowing investors to have an equity stake in exchange for capital. However, SIX is not the only exchange looking to integrate blockchain technology. The Deutsche Börse also said that it has made significant progress on its securities lending platform, which will be based on blockchain technology. Follow BitcoinNews.com on Twitter: @bitcoinnewscom Telegram Alerts from BitcoinNews.com: https://t.me/bconews Want to advertise or get published on BitcoinNews.com? – View our Media Kit PDF here. Image Courtesy: pexels.com The post Swiss Stock Exchange to Integrate Blockchain Technology appeared first on BitcoinNews.com.

Read in browser »

Recent Articles: |

Recap - Day in Crypto - BitcoinNews.com for 02/08/2019