Dear Friend, Bitcoin has crossed the psychologically important $4,000 mark and has been able to mostly hold its ground. Furthermore, altcoins have started to flash green lights on a semi-consistent basis.

Buoyed by the recent trend in IEOs, some have started to call for another token offerings bonanza. Market insiders have started to declare a market bottom with more confidence, and some have even begun to talk about a possible rally. We approach the new uptrend with cautious optimism, as it reminds us too much of the 2017-2018 hype cycle

Our focus remains on adoption and fundamentals, but with Spring taking a firm hold and the sun shining, we are ever hopeful that the crypto winter is over.

Overall Crypto Market Cap (via Coinmarketcap.com)

Market Analysis

The capitalization of cryptocurrency market rose from $125,201,365,403 to $148,259,967,351, marking a steady improvement from the worst levels of February, where the marked dipped close to the $110,000,000,000 level with the lesser known coins once again dominating the trading action among the biggest gainers and losers.

Bitcoin's overall market dominance slipped closer to the 50 percent mark, in a trend that has been in place since September of last year. The number one cryptocurrency became trapped in its narrowest trading range since July 2017, as the BTC/USD pair struggled to find direction.

In the top fifty, Tezos, Cardano, Ontology, Ravencoin, Crypto.com Chain and Basic Attention have all seen significant positive price movement. Basic Attention enjoyed a steady stream of weekly gains, with the popular cryptocurrency adding over sixty percent to its overall value at the monthly close.

We have published our initial report and investment grade on BAT here on January 31st when the price was $0.11. Current price of BAT is now $0.28 for an ROI of 143%.

Basic Attention Daily (Chart Source-Cryptocompare.com)

BlockCDN claimed the title as the biggest gainer for the month of March, with the cryptocurrency advancing a stunning one thousand percent. Other notable gainers outside the top fifty by market capitalization included Hurify and Decentraland.

Ethereum and Ripple became the notable under-performers, with Ripple trading perilously close to a major technical break down below the $0.3000 level. The third largest currency has continually struggled to attract buying interest, while other new contenders gain market share.

Ethereum failed to break above its 2019 trading high last month, with the second largest cryptocurrency confined to a narrow trading range, although it remained extremely resilient on any technical pullbacks towards major support.

Going into the new month of April it will be interesting to see if the overall cryptocurrency market can continue to advance while Bitcoin remains fairly muted; and indeed the market's reaction if Bitcoin does eventually start to rally above the $4,000 level.

Technically the BTC/USD pair is primed for a breakout, with major monthly support located at the $3,850 level, while major monthly resistance is found at the $4,280 level. Any sustained breakout from this price range and we could see a major pick-up of trading volumes.

We are also starting to see a number of coins turning technical bullish over the medium-term. With Binance Coin, Ontology, DASH, QTUM, EOS, and MAKER some of the more popular digital currencies to advance above their respective 200-day moving averages.

All aboard the hype train

The buzzword of the early 2019 has definitely been IEO. Seen as a close relative of the ICO, it started out as a much anticipated mostly well thought through product from Binance.

The first three BitTorret, Fetch.AI, and Celr offerings, were gobbled up like hot cakes. The strategy looked simple: create an air of exclusivity add a dash of liquidity and watch the money poor in. Despite the technical glitches, people complaining about not being able to get in on the sale, and rumors of insider deals (shocking) the sales on Binance Launchpad could be considered a success.

To be fair, the IEO was supposed to provide end users with a number of benefits, but as the old saying goes, "the road to hell is paved with good intentions".

(Comparison table from Crypto Potato)

So, with the business model battle- tested, all of the other exchanges decided to join in on the fun. Now we have an IEO product announced from Huobi, KuCoin, OKEx, BitMax, Bittrex, and many many more. Smaller exchanges like LAToken and even DEXs like Kyber Network are looking for their piece of the crypto pie.

With everyone with a semi-functional exchange looking to offer an IEO, the illusion of exclusivity is becoming even more artificial and with regards to liquidity, it has been the industry's worst kept secret that the volume numbers have been more pumped than baseball players during the steroids' heyday.

As a result, we have a race among exchange executives to roll out something, anything, with less and less regard for the quality of what's being offered to the market. Bittrex's debacle with the RAID offering is likely a sign of what has descended upon the industry. We simply don't see enough quality projects to merit the fanfare and the soaring valuation that results from IEO affairs.

Some exchanges appear to be so afraid of tightening regulation cutting off future revenue streams that they are playing with a discount factor of 100% and are willing to sacrifice quality and any remnants of respectability for short term gains.

Still, there are definitely some solid projects around and over the coming weeks we will be publishing our analysis on projects angling for an IEO. We will be considering the projects and the underlying assets from both a short-term and long-term perspective, and looking at the token release math as well as the fundamentals.

Are you surprised that no one is surprised?

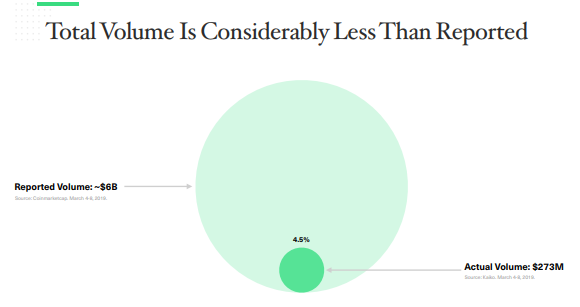

This month marked the release of the Bitwise Asset Management's report, that revealed (for the nth time) that the vast majority of the stated volume in the market is fake.

Real volume vs reported volume

The report went as far as to name the 10 exchanges that can be trusted and pointed out the ones that are suspect.

Exchanges with real volume

Predictably, anyone with any knowledge of the market space went "Duh!" This is far from the first report exposing volume manipulation at exchanges. Sylvain Ribes drew attention to the issue back in March of 2018, then Blockchain Transparency Institute published a report in August, while Bloomberg covered the issue in September, before Blockchain Transparency Institute published an update in December. So, at its core, this is not news at all.

What is interesting are the context, details and possible implications. First of all the report comes as a backdrop to a Bitwise attempt to get SEC approval for its ETF proposal. Getting an ETF has been a long-pursued dream of the industry, filled with anguish and disappointment to date. The hope is that Bitwise's approach will finally get the job done. Since Bitcoin liquidity is significantly smaller than commonly stated, the effect of the ETF on the price of the asset could be bigger than expected.

It is also interesting to see the Bitwise ETF proposal address the SEC's concerns of manipulation by using a Volume Weighted Median Price to calculate its NAV. You can read more about this approach starting from page 101 of the Bitwise ETF proposal

Also worthy of attention is that of the ten honest exchanges, only one, Binance, is not a registered entity. With regulation slowly but surely starting to materialize, unregulated exchanges could see increased scrutiny. Wash trading is frowned upon by the SEC and the rampant abuse of volume number could give regulators cause to forcefully step in, to protect consumers.

Some of the leading data providers in the industry have already started to reflect this difference between real volume and reported volume. For example, Messari's onchainfx platform now displays the "Real 10" 24hr volume by default.

So, it can be expected that the biggest offenders to start to attempt to make themselves more presentable in order to defend their independence. Recently, in a conversation with our own Paddy Baker, a senior OKEx executive acknowledged the presence of suspicious behavior on the exchange. While this is not an admission of guilt, it does signal the fact that questionable exchanges are recognizing that things cannot remain as they are indefinitely.

With luck, this could lead us to a cleaner more transparent market, something that is sorely needed by the industry.

Talk around the institutional water cooler

The recent uptick in the market has been accompanied by a concerning trend. While the altcoins are showing incredible growth it is troubling that the majors have remained rather tame. Net flows are still neutral and the more liquid assets like bitcoin and ether are rather quiet. For the rally to materialize into something substantial that will need to change. Still, there is a belief that we have finally ended the recession, but it is unclear how the recovery will maintain the snail-like pace.

In other news, Japan is now looking like the land of hopes and dreams for crypto. On the surface, Rakuten and DeCurret have received regulatory approval, in a market with a lot of crypto interest. However, what is less covered, but perhaps even more important is that big corporations are looking to move into crypto with their own coins. Big brands have the luxury of having existing user bases and when they do move into the space it will create a massive spike in adoption numbers. Right now the average person looks at crypto as something exotic and perhaps as an opportunity to get rich quickly (if the market recovers).

However, if established companies get the customers to start using blockchain-based applications and transacting in crypto assets, than the addressable market for the industry as a whole will grow tremendously.

The arrival of Eris X is still a hot topic. Starting with Q2 we should start seeing some launch announcements coming, which should positively affect liquidity in the market space.

Eris X roadmap

Given the heavyweights behind this platform this could be one of the catalysts for the much anticipated arrival of major institutional funds.

With that being said, the macro picture is becoming more and more important. It is often the case for industry analysts to consider the space in a vacuum. However, that presents an inaccurate picture. Simply speaking, the more money there is available for investment globally, the more money the industry can attract. More than that, as crypto assets become a legitimate alternative investment asset, the risk-on and risk-off macro dynamics will become vitally important.

At the end of the day, everyone agrees that what is needed to take the next step in the market's development are new users. Japan could play a key role in opening the consumer floodgates.

The Altcoin party

This month we have seen some incredible growth of coins given a seemingly absence of tangible news. However, at least some of the activity looks like buying in anticipation of catalysts. The likes of Cardano, QuarkChain and IOST have been marching up towards development release dates. Some like Dash, with more obscure release dates (see our DARE Update report) are acting tamer.

Some distressed assets, like NEM have been using hope for a turnaround as a catalyst. It will be important to see how the market reacts to those events when they happen. In the past, testnet and mainnet releases were often accompanied by coin dumps characterized by a rush to take profits.

In that light this mini bull run could prove to be very dangerous in the short-term. If projects start to miss milestone dates it could kick-off a wave of run-for-the-door selling, while hitting the milestones could result in a profit-taking run. Either way we could be looking at a sea of red over the next few months.

In an equities scenario it would not be outrageous to see price go up in anticipation of a big release as people begin to factor in effects on price. However, in the absence of a real conversation of how a given release materially affects the prospects of a project and its ecosystem, we are looking price speculation being timed to look plausible. We hope that the market is maturing, but given the current pattern of activity, we are concerned about short-term fluctuations.

New ETF Dates to Look forward to

On March 29th the SEC announced it will delay its decision on the Bitwise ETT proposal for another 45 days, making the new deadline for decision May 16, 2019. The SEC, on the same day, also announced its delay on the CBOE / VanEck / SolidX ETF decision and designated May 21st, 2019 as the new deadline.

So May 16th and May 21st are the new dates to look forward to in ETFs.

What does this all mean?

The market is still undisciplined and for many short-term gains trump long-term prospects. At the same time, development continues. Progress is often obscured by price swings, which are hard to trust. There is a lot of money on the sidelines waiting anxiously for a sign that the industry is finally taking off, but 2x and 3x returns on rampant speculation is definitely not it.

The market is full of people who are looking to recoup the losses of the previous year and are willing to do so at the expense of quality and consumer safety. So, it is as important as ever to continue to do your own research regarding investments in crypto assets, be it through and ICO, IEO or STO.

We are inching closer to mainstream adoption, but not nearly as quickly as crypto optimists would hope. Japan is poised to become an important region in terms of adoption and trading volume. The expectations of major corporations stepping in could be a real game-changer as that will usher in adoption unseen in the industry to this point.

Also with the market picking up I realize monthly roundups may not be good frequent enough for everyone. So I have made a commitment to become more active on Twitter and sharing market insights and commentary on a more frequent basis via my personal Twitter. Click below and follow me on Twitter.

|

March Crypto Roundup and What to Expect in April